Life Insurance Awareness Month (2022)

Life Insurance Awareness Month

Every September, the industry — led by Life Happens — comes together to sponsor Life Insurance Awareness Month. This campaign is designed to educate consumers about the importance of life insurance and the role it plays in protecting families’ financial security. LIMRA(formerly “Life Insurance Marketing and Research Association”) is proud to support Life Insurance Awareness Month (LIAM).

September Is Life Insurance Awareness Month

The global pandemic raised awareness of how fragile life is and the importance of preparing for the unexpected. According to LIMRA research, 31% of Americans say they are more likely to buy life insurance as a result of COVID-19. This is even higher across many demographics, including Millennials (44%), Black Americans (38%), and Hispanics (37%).

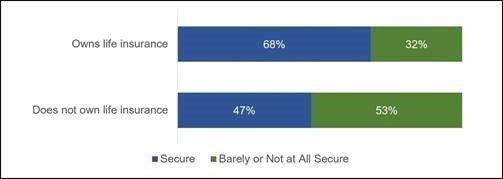

Our research also shows that people who own life insurance are more likely to feel financially secure. Nearly two thirds of insured Americans say they feel financially secure, compared with less than half of those uninsured.

Overall, 41% of Americans say they don’t have sufficient life insurance coverage. Many underserved markets have even greater insurance needs, including:

- 44% of women believe they have a life insurance coverage gap

- 45% of Asian Americans say they need more coverage

- 47% of Millennials live with a life insurance coverage gap

- 48% of Black Americans acknowledge they don’t have enough life insurance

- 50% of LGBTQ+ Americans say they need (or need more) coverage

This is increasingly critical since LIMRA research shows that 4 in 10 families say they would face financial hardship within six months if the primary wage earner died. For 1 in 5, it would be within just one month.

There are at least 106 million Americans living with a life insurance coverage gap. To help raise awareness, LIMRA joined seven trade associations and 76 life insurers and distributors to launch the “Help Protect Our Families” campaign to address the growing coverage gap in the U.S. Now in its second year, the campaign if focusing on an underserved market each month, including Black Americans, women, Asian Americans, Millennials, middle-income, etc.

There are several types of life insurance that designed for specific applications and purposes. How much does my family need? What type of coverage would be best for our situation? Getting the answers to these and other important questions start with a conversation with a seasoned professional. Contact our office and allow us to provide you with the resources to help you determine if your needs are being addressed.

marklee@markleeandassociates.com

Blog